The Southern Arkansas University Foundation, Inc. recently named seven new members to its governing board.

The new members include Charlotte A. Baine, Roger Bell, Michael Ray Dumas, Dr. David Rankin, Terry “Bo” Ray, Betty J. Stringfellow, and Beth Cameron Weldon.

Baine, of El Dorado, is a 1994 SAU graduate and is a retired Middle School Counselor with the Crossett School District. She is a member of the Arkansas Retired Teachers Association, a board member for the South Arkansas Historical Society, an officer on the Union County Genealogical Society, and a member of the Poets Roundtable of Arkansas, South Arkansas Arts Center, First Baptist Church, and the SAU Alumni Association. She is also a member of Sustaining El Dorado Service League and the Arkansas School Counselors Association. She and her husband, James Baine, have four children – Kelly Cook, Angelia Cox, Henry Frisby, II, and Hon. John Baine.

Baine, of El Dorado, is a 1994 SAU graduate and is a retired Middle School Counselor with the Crossett School District. She is a member of the Arkansas Retired Teachers Association, a board member for the South Arkansas Historical Society, an officer on the Union County Genealogical Society, and a member of the Poets Roundtable of Arkansas, South Arkansas Arts Center, First Baptist Church, and the SAU Alumni Association. She is also a member of Sustaining El Dorado Service League and the Arkansas School Counselors Association. She and her husband, James Baine, have four children – Kelly Cook, Angelia Cox, Henry Frisby, II, and Hon. John Baine.

Bell, of Shreveport has earned two degrees from SAU (1972 and 1977). He also has four members of his immediate family who  are SAU graduates, including his wife, Pamela Freeman Bell, and his three daughters. He is a financial advisor with LPL Financials in Shreveport. He is a member of the Financial Services Institute and of Shreveport Community Church. He said he hopes to use his business experience with other members of the board to expand the Foundation’s efforts. His four children are Polly Lee, Roxie Waller, Suzann Becnel, and Jonathon Bell.

are SAU graduates, including his wife, Pamela Freeman Bell, and his three daughters. He is a financial advisor with LPL Financials in Shreveport. He is a member of the Financial Services Institute and of Shreveport Community Church. He said he hopes to use his business experience with other members of the board to expand the Foundation’s efforts. His four children are Polly Lee, Roxie Waller, Suzann Becnel, and Jonathon Bell.

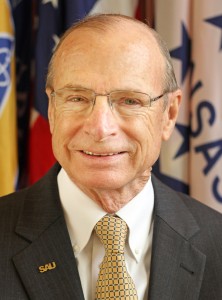

Rankin, of Magnolia, is SAU president emeritus and brings to the Foundation Board more than

Stringfellow, of Little Rock, is the widow of William R. Stringfellow, former SAU Board Chairman who passed away in 2014. She and her late husband have been an important part of SAU for some time, and she hopes to continue her interest in SAU by serving on the Foundation Board. She brings vast experiences from the corporate world, along with knowledge from her years of attending and serving SAU. She is a member of Christ Episcopal Church and of the Country Club of Little Rock.

The Foundation Board of Governors consists of 25 volunteer governors, both alumni and friends, who serve three-year terms. Southern Arkansas University Foundation, Inc. was established in 1981 to enhance and expand opportunities at SAU though private philanthropy. Its mission is to assist and coordinate in raising and managing funds and resources on behalf of SAU to be used exclusively in furthering the literary, scientific, and educational purposes of the university. As a 501 (c)(3) corporation, the Foundation qualifies donations as tax deductible contributions under IRS guidelines and maintains a record of private philanthropy to the University.